Executive Summary

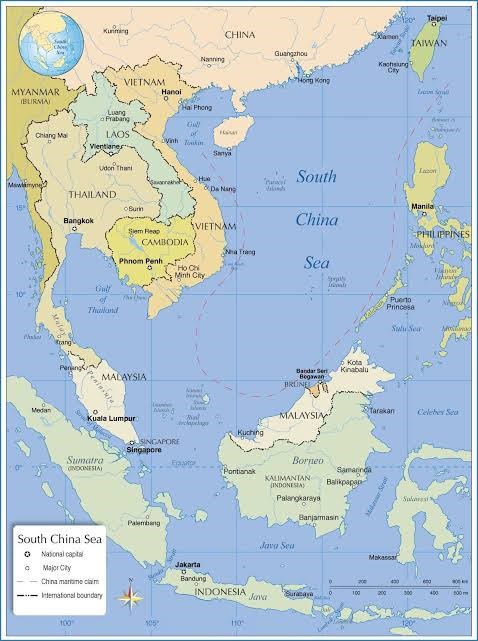

The fire-resistant coatings market in South-Eastern Asia is in a pivotal phase, driven by regulatory reforms, rapid infrastructure development, and enhanced focus on industrial safety. Analyzing the market up to 2026 and forecasting through 2035, this report emphasizes the sector’s evolution from a compliance-driven domain to a strategic necessity in construction and industrial design, crucial for risk management and asset protection.

Economic growth in the region is a major growth driver, prompting substantial investments in commercial real estate, energy infrastructure, and transportation. Concurrently, tragic fire incidents and evolving safety standards are compelling governments in ASEAN to revise and enforce building codes, creating a sustained demand for fireproofing materials across various sectors including construction, manufacturing, and public infrastructure.

Market Overview

The fire-resistant coatings market includes specialized products aimed at delaying flame spread and enhancing structural integrity during fires. Key types include intumescent, cementitious, and ablative coatings, applicable to materials such as steel, wood, and concrete. Demand is concentrated in major economies—Indonesia, Thailand, Vietnam, Malaysia, and the Philippines—where growth in new construction and manufacturing is significant. Singapore functions as a regional hub for high-specification projects and compliance benchmarks.

The supply chain involves raw material suppliers, coating formulators, and a network of contractors, heavily influenced by specifications from architects and engineers. As the market matures toward 2035, integration among players and specialized contractors is expected to grow, emphasizing correct installation essential for performance.

Demand Drivers and End-Use

Urbanization and economic expansion propel demand for fire-resistant coatings, particularly in high-rise and industrial constructions. In addition, stringent regulatory shifts post-tragedies are mandating enhanced fire protection standards, both in new developments and retrofitting existing structures.

Key end-use segments include:

- Commercial & Residential Construction: This largest segment includes office buildings, malls, and luxury apartments.

- Industrial & Manufacturing: Applications range from oil and gas facilities to power stations, focusing on asset protection.

- Infrastructure Projects: Public structures like airports and transit systems necessitate high safety specifications.

- Marine & Offshore: This established segment is driven by safety regulations within maritime industries.

Sustainability trends are also emerging, as green building certifications increasingly promote fire safety as part of overall safety and performance.

Supply and Production

The supply landscape features a mix of multinational corporations and local manufacturers, with global players dominating due to their R&D capabilities and established reputations. Regional firms compete on pricing and local insights, often tailoring products to meet specific compliance standards.

Production is concentrated in industrial regions across Thailand, Malaysia, and Indonesia, benefiting from established chemical manufacturing ecosystems. Recent global disruptions have highlighted supply chain vulnerabilities, leading companies to reassess networks and explore local sourcing alternatives. Environmentally friendly formulations are gradually becoming the norm in response to tightening regulations.

Trade and Logistics

International trade is vital, with Southeast Asia being a net importer of high-specification coatings. The region relies on imports from Europe, North America, and Northeast Asia for advanced product certifications. Regional trade is robust, with substantial intra-regional exports of mid-tier products.

Logistics present challenges due to the specialized handling required for fire-resistant coatings, necessitating strategic distribution networks. The complexity is heightened by hazardous material regulations impacting supply chain and delivery methods.

Price Dynamics

Pricing is influenced by the cost of raw materials and the competitive landscape. Standard coatings compete primarily on price, while high-performance products for specialized applications command premiums. Procurement processes affect price dynamics, with large projects leading to negotiations but smaller projects often incurring higher costs through distributors.

Competitive Landscape

The market is tiered, with multinationals focused on premium products and technical consultancy, while regional firms prioritize localized agility and compliance at competitive prices. Key strategies include technical services, sustainability positioning, and digital tools for effective client engagement.

Mergers and acquisitions may reshape the market landscape, but it is likely to remain fragmented at the lower tiers due to numerous local players.

Conclusion and Implications

The fire-resistant coatings market in South-East Asia is projected for durable growth, transitioning to a phase of innovation and application diversification. Key implications involve a shift towards specialized product development, enhanced training in application techniques, and the necessity for a holistic view of procurement considering lifecycle costs.

Collaboration among coating suppliers, contractors, and project owners will be essential to maximize safety, compliance, and risk management, ensuring that fire-resistant coatings become integral to resilient infrastructures in the region by 2035.

Original publication date: [original_date]